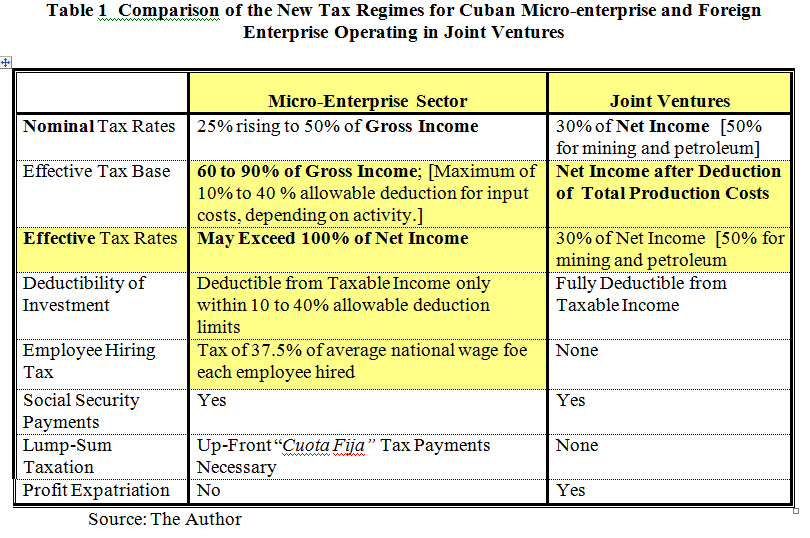

Micro-enterprise Tax Reform, 2010: The Right Direction but Still Onerous and StultifyingThe Cuban Economy – La Economía Cubana

Amazon.com: Management of small and micro enterprises Series: small micro- enterprise financing and tax guide(Chinese Edition): 9787550505667: 王晓文著: Books

Good News – Microenterprise Tax Credit Increased/Extended | Omaha CPA | Quickbooks Support | Tax Prep | Bookkeeping